BUSINESS

Tower Loan Uncovered: What You Need to Know Before You Borrow

Tower Loan Uncovered At its core, Tower Loan is a consumer-driven financial services provider specializing in unsecured personal loans. It began serving customers in 1999 and has grown into a network of brick-and-mortar branches across the southeastern and southwestern United States. The company’s emphasis on fast approvals and flexible repayment plans has positioned it as a go-to lender for those in need of emergency cash or short-term credit.

Loan Types Offered by Tower Loan

Short-Term Installment Loans

Short-term installment loans at Tower Loan allow borrowers to repay over several months. These contracts, unlike revolving lines of credit, have fixed payment schedules. Borrowers appreciate the predictability and clarity of knowing exactly when loans are paid off.

Personal Loans for Everyday Expenses

Tower Loan also offers personal loans to cover routine expenses like car repairs, medical bills, or home maintenance. These unsecured installment loans typically range from a few hundred to several thousand dollars, depending on local lending laws and eligibility.

Title Loan Option

In select regions, Tower Loan provides vehicle title loans, where borrowers use their car title as collateral. While these loans can offer higher amounts, they come with increased risk if payments are missed, as they may lead to repossession.

Application Process: From Inquiry to Funding

Loan Application Made Easy

Applying for a loan with Tower Loan can be done either online or in-person at one of their branches. Applicants need basic documentation: a valid ID, proof of income, and bank account details. During the process, a representative or digital platform will conduct a credit check and confirm employment or income level.

Snapshot of Approval Timeline

Approval may come as quickly as within an hour, although certain cases might take longer. Once approved, funds can be disbursed via direct deposit to the applicant’s bank account or as a check—either mailed or picked up in-store.

Understanding Interest Rates and Fee Structures

Interest Rates Explained

Tower Loan’s annual percentage rates (APRs) vary based on loan type, loan amount, and state regulations. For unsecured white-collar personal loans, APRs may range from 25% to 120%, while vehicle title loans can exceed 200% APR. These rates reflect the high-risk nature of unsecured lending.

Service Fees and Prepayment Policies

Borrowers should be aware of origination fees— sometimes a flat fee or a percentage of the loan amount—charged upon fund disbursement. Good news: Tower Loan generally supports prepayment with little to no additional fee, enabling borrowers to reduce total interest costs by paying early.

Tower Loan vs. Other Lenders: Where It Stands

Comparison with Payday Loans

Unlike traditional payday loans, which are due on the borrower’s next payday, Tower Loan’s installment model stretches payments out, making it more budget-friendly than lump-sum repayment options.

How It Compares to Credit Cards

While credit cards offer revolving credit, Tower Loan’s installment format provides fixed schedules and clearer repayment expectations. However, credit cards often come with lower APRs—especially for those with good to excellent credit scores—though they may also include hidden fees.

Alternative Lenders and Banks

Banks and credit unions tend to have stricter qualification criteria and slower approvals. Online lenders, on the other hand, may offer quicker access to funds but sometimes at higher interest rates. Tower Loan positions itself in the middle, capitalizing on speed, accessibility, and local branch support.

Regulatory Oversight and Compliance

State Licensing and Consumer Protections

Tower Loan operates under varying state-by-state regulations. This ensures the company follows lending limits and disclosures as mandated by each jurisdiction. In some states, small-dollar lending rules cap loan amounts and rates, while others allow more flexibility.

Disclosure Requirements

Prospective borrowers receive a clear Truth-in-Lending Disclosure, which outlines the total cost of the loan, APR, finance charges, payment schedules, and any applicable fees—achieving transparency and empowering borrowers to make informed decisions.

Consumer Rights

Borrowers at Tower Loan benefit from protections under legislation like the Consumer Financial Protection Act, which guards against predatory lending. Additionally, state regulators often offer mediation services in cases of dispute.

Customer Experience and Support Services

Branch Experience

Many borrowers appreciate the face-to-face interaction available at Tower Loan’s physical branches. Branch staff assist with applications, repayment processing, and general questions, offering a level of personal service that online-only lenders cannot replicate.

Online Account Management

Digital-savvy borrowers can monitor their accounts online—checking balances, making payments, and downloading repayment schedules. This dual online-in-branch approach addresses varying customer preferences.

Borrower Feedback and Reviews

Customer reviews are mixed. Some users commend the company for transparent service and swift funding, while others cite the high cost as a drawback. Despite this, many acknowledge Tower Loan as a viable solution during financial emergencies.

Responsible Borrowing with Tower Loan

Crunching the Numbers

Before applying, borrowers should calculate total repayment amounts—factoring in both principal and finance charges—to assess affordability throughout the loan term.

Exploring Alternatives

It’s wise to compare other options: credit union loans, personal lines of credit, peer-to-peer lending platforms, and employer-based payday advances. These alternatives may offer lower APRs or more flexible terms.

Creating a Repayment Strategy

Mapping out a repayment plan prior to borrowing—integrating monthly loan payments into a budget—helps avoid defaults and maintain a healthy credit profile. Timely payments at Tower Loan can also bolster credit if reported to bureaus.

Entities and Semantic Relevance

Throughout this article, terms like personal installment loans, annual percentage rate, direct deposit, vehicle title collateral, origination fees, secure lending, consumer protection regulations, and financial emergency support serve as entities. They strengthen the article’s relevance for search engine queries about short-term lending, borrowing responsibly, loan financing, and debt management.

FAQs

What credit score do you need for a Tower Loan?

Tower Loan typically doesn’t publish a strict credit score requirement. They evaluate applicants on total income, job stability, and banking history. Applicants with lower credit may still qualify, though likely at higher APRs.

How quickly can I get money from Tower Loan?

Approval may occur within minutes of submission, and funds are often available the same day via direct deposit. In-store loans might even be issued as a check on the spot.

Can I pay off my Tower Loan early?

Yes. Borrowers are allowed to pay off loans ahead of schedule, and doing so can significantly reduce total interest paid. Tower Loan generally doesn’t impose prepayment penalties.

Is Tower Loan regulated by state or federal laws?

Yes—both. It operates under federal consumer protection laws such as the CFPB guidelines, and it must also adhere to individual state regulations covering APR caps and fee restrictions.

What happens if I miss a loan payment?

Missing a payment may result in late fees and negatively affect your credit score. In case of repeated delinquency, Tower Loan could initiate collections and potentially involve rate increases or legal action.

Conclusion

Tower Loan Uncovered reveals a lender that has carved a niche in the personal lending landscape by prioritizing rapid funding, flexible repayment terms, and accessible branch services. While its interest rates and fees may surpass those of traditional banks, Tower Loan remains a lifeline for individuals needing quick access to funds. Borrowers should approach with caution—fully understanding total repayment obligations and exploring comparative alternatives. Ultimately,

BUSINESS

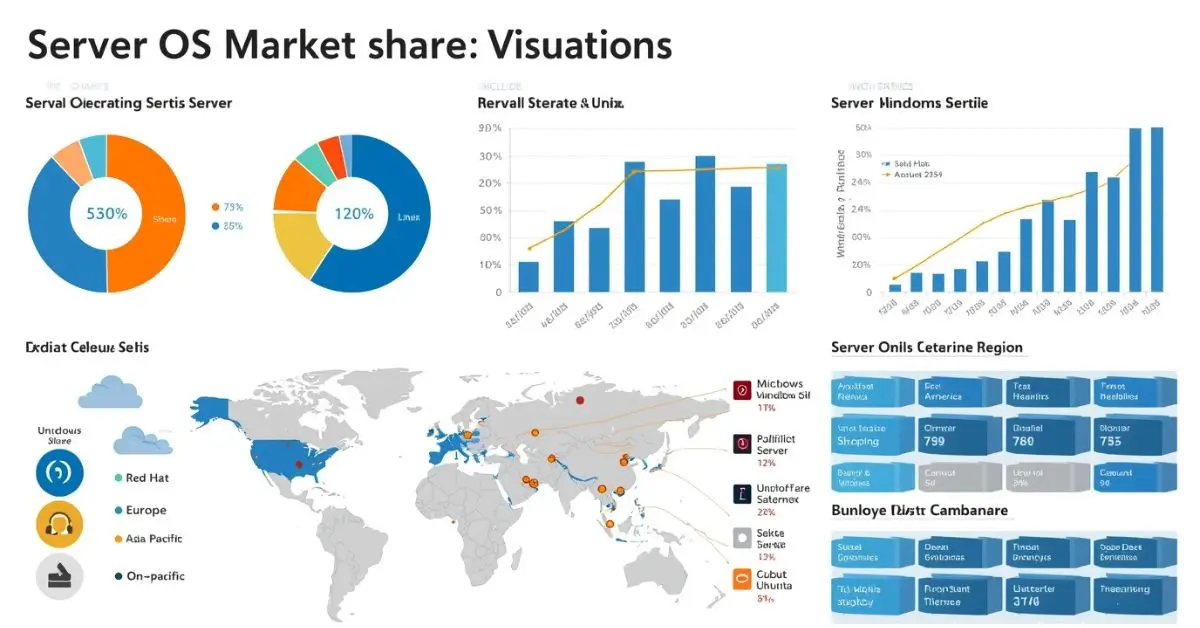

Server OS Market Share Analysis for IT Leaders

When it comes to powering modern businesses, understanding server OS market share isn’t just a technical curiosity—it’s a strategic advantage. Whether you’re a CIO planning infrastructure upgrades, a DevOps engineer choosing the next cloud stack, or a student researching enterprise IT, knowing which server operating systems dominate the market helps shape better decisions.

But here’s the real question: Why are some operating systems growing while others are fading away? And what do the numbers say about Linux, Windows Server, and Unix in 2025? Let’s dive into the data, trends, and predictions that define the server OS landscape today.

The Global Server OS Market share Report

The global server OS market share report shows that operating system dominance shifts with technological changes. From the early dominance of proprietary Unix systems to the rise of Linux server OS adoption, we’ve seen consistent evolution.

Today, enterprises balance between open-source flexibility, commercial support, and cloud-native compatibility. Key highlights in 2025 include:

Server Operating System Usage Statistics in 2025

Latest server operating system usage statistics reveal fascinating patterns:

- Linux powers roughly 70% of global web servers, largely due to cost-effectiveness and developer community support.

- Windows Server holds around 20% of the market, with strength in hybrid enterprise deployments.

- Unix and BSD derivatives account for less than 5%, but retain loyal users in mission-critical systems.

- Cloud-native OS distributions like Container-Optimized OS and CoreOS are gaining traction in specialized workloads.

One sysadmin recently tweeted: “Every migration project we’ve done this year ended up on Linux. Stability, cost savings, and performance make it the default choice.”

Linux Server OS Adoption

When we talk about Linux server OS adoption, we’re not just discussing a technology choice—it’s a cultural and economic movement. Companies like Netflix, Meta, and Google run massive infrastructures on Linux.

Why?

- Cost savings: Open-source eliminates licensing fees.

- Flexibility: Supports customization and container orchestration.

- Security: Rapid community-driven patching.

Distributions like Ubuntu Server and Red Hat Enterprise Linux continue to dominate, each catering to different segments. Ubuntu appeals to startups and developers, while Red Hat thrives in enterprise IT.

Windows Server Market Share

The Windows Server market share may be smaller than Linux, but it holds a powerful niche. Enterprises running Microsoft ecosystems—like Exchange, SharePoint, and Azure Active Directory—depend heavily on Windows Server.

Key strengths include:

- Seamless integration with Microsoft 365 and Azure.

- Strong enterprise-grade support and compliance certifications.

- Familiarity for IT teams with existing Microsoft expertise.

Despite challenges, Windows Server remains indispensable in hybrid cloud deployments where companies want a mix of Linux and Microsoft environments.

Unix Server OS Trends

While Unix server OS trends show a slow decline, the technology is far from extinct. AIX, Solaris, and HP-UX continue to power critical banking, telecom, and government systems.

Why are some organizations still using Unix?

- Stability over decades.

- Certified applications that aren’t easily portable.

- Strong vendor support in regulated industries.

That said, the high licensing costs and limited innovation compared to Linux mean Unix will likely remain niche.

Cloud Server OS Comparison

In 2025, the cloud server OS comparison is one of the most dynamic aspects of IT infrastructure. Cloud providers like AWS, Google Cloud, and Azure optimize their own OS distributions for performance.

- AWS Linux 2025: Tuned for EC2 performance, with native integration.

- Google’s Container-Optimized OS: Lightweight, built for Kubernetes workloads.

- Microsoft Azure Stack HCI: Combines Windows Server roots with hybrid flexibility.

The takeaway? Cloud-native operating systems are reshaping how we think about traditional OS dominance.

Enterprise Server Operating Systems: What Businesses Use Most

When we look at enterprise server operating systems, the decision often balances innovation with reliability. Large corporations don’t always chase trends—they prioritize long-term stability.

Key choices in enterprises:

- Red Hat Enterprise Linux: Strong commercial support and certifications.

- Windows Server: Integration with Microsoft enterprise software.

- Ubuntu Server: Popular in development and DevOps pipelines.

Budget, staff expertise, and compliance requirements heavily influence the final choice.

Datacenter OS Popularity

Datacenters remain the backbone of IT, and datacenter OS popularity reflects how businesses run workloads at scale. Here’s what’s trending:

- Linux leads for scalability and open-source cost benefits.

- Windows Server dominates in Microsoft-centric environments.

- Unix lingers in legacy datacenters but rarely sees fresh adoption.

With edge computing growing, lightweight Linux distributions are particularly popular in micro-datacenter deployments.

Red Hat vs Ubuntu Server Share

The battle of Red Hat vs Ubuntu server share highlights different philosophies.

- Red Hat Enterprise Linux (RHEL): Enterprise-grade, with strong vendor backing, certifications, and long-term support.

- Ubuntu Server: Developer-friendly, widely adopted in startups, cloud-native apps, and container workloads.

In market share terms, Ubuntu dominates cloud deployments, while Red Hat excels in Fortune 500 enterprises.

Server Software Industry Trends

The server software industry trends in 2025 reflect the shift toward:

- Containerization: Kubernetes and Docker driving lightweight OS usage.

- AI-ready infrastructures: Optimized OS versions for machine learning workloads.

- Zero-trust security: Demand for OS-level hardening.

- Hybrid and multi-cloud: Businesses need OSes that integrate across environments.

These trends make OS selection less about loyalty and more about workload optimization.

Pros and Cons of Leading Server OS Options

| Server OS | Pros | Cons | Best Fit |

|---|---|---|---|

| Linux | Free, customizable, secure, scalable | Steeper learning curve for some admins | Cloud, web hosting, modern enterprises |

| Windows Server | Strong enterprise integration, Azure synergy | Licensing costs, heavier resource use | Hybrid enterprises, Microsoft shops |

| Unix | Rock-solid stability, legacy support | Expensive, less innovation | Banking, telecom, regulated sectors |

| Cloud-native OS | Lightweight, optimized for containers | Limited outside cloud ecosystem | Cloud-first businesses, DevOps |

The Future of Server OS Market Share

Looking ahead, we’ll likely see:

- Continued dominance of Linux in cloud and datacenter markets.

- Steady but reduced role for Windows Server in enterprises.

- Unix shrinking into a legacy niche.

- Growth of container-optimized and AI-tailored operating systems.

For businesses, the message is clear: adapt your server OS strategy to match workload demands, not just historical preference.

FAQ’s

What is the most popular server operating system in 2025?

Linux remains the most widely used server OS worldwide, especially in cloud and web hosting environments.

How does Windows Server market share compare to Linux?

Windows Server holds around 20% of the market, strong in enterprise use cases, but Linux leads overall with nearly 70%.

Why is Unix still used if it’s declining?

Unix systems continue to run critical workloads in banking, telecom, and government because of their stability and long-standing certifications.

Which OS should small businesses choose?

For cost and flexibility, Linux-based solutions (like Ubuntu Server) are often the best choice. Small businesses deeply tied to Microsoft tools may prefer Windows Server.

Conclusion

The server OS market share tells a story of evolution, competition, and adaptation. From Linux’s unstoppable growth to Windows Server’s loyal enterprise base and Unix’s quiet persistence, the numbers reflect broader IT trends.Whether you’re running a global data center or a startup cloud deployment, your OS choice should align with budget, performance, and future growth.

BUSINESS

What Is Shein Saver and How Can It Save You Money?

If you shop at Shein often, you’ve probably noticed a “Shein Saver” option at checkout and wondered what it means. For budget-conscious shoppers, deal hunters, and fashion lovers, knowing what is Shein Saver can help you save money, enjoy perks, and make smarter purchasing decisions. This guide breaks it all down—how it works, its benefits, and whether it’s worth it for your shopping habits.

What Is Shein Saver and How Does It Work?

The Shein Saver program is Shein’s way of helping shoppers reduce costs by offering cheaper or sometimes free shipping when customers choose a slower delivery option. Instead of paying extra for express delivery, Shein Saver rewards you for being flexible with shipping times.

- Lower shipping fees compared to standard checkout options

- Occasional bonus perks, such as coupons or points

- Eco-conscious delivery by grouping shipments together

Think of it as Shein’s budget-friendly alternative to fast shipping, aimed at frequent customers and savvy buyers.

Shein Saver Benefits vs Regular Shein Shopping

| Feature | Regular Checkout | Shein Saver Option |

|---|---|---|

| Shipping Speed | Standard/Express | Slower, consolidated |

| Cost | Higher | Lower or Free |

| Coupons & Discounts | Limited | Often Included |

| Eco-Friendly Packaging | Not prioritized | More optimized |

By choosing Shein Saver, customers often unlock extra Shein coupons and discounts, while also saving on shipping.

Key Shein Saver Membership Benefits

While not a paid subscription, Shein Saver acts like a mini loyalty program inside the platform:

- Cheaper delivery options – Save on shipping fees

- Shein free shipping options – Sometimes available through Saver

- Bonus Shein points and cashback – Redeemable on future purchases

- Sustainable shopping perk – Reduced packaging footprint

These small perks make a big difference for regular Shein buyers.

Is Shein Saver Worth It for Frequent Shoppers?

If you’re a frequent Shein customer, Shein Saver is almost always worth selecting. While you may wait a bit longer for delivery, the membership benefits include consistent savings and the chance to stack Shein deals and promo codes with your Saver orders.

For casual shoppers who only place one or two orders a year, the impact may be less noticeable—but for loyal customers, the Shein rewards system adds up quickly.

How to Join the Shein Saver Program

Unlike premium memberships, you don’t need to sign up separately for Shein Saver. Instead:

- Add items to your cart

- Proceed to checkout

- Look for the “Shein Saver” option under shipping methods

- Select it for lower or free shipping

That’s it! No subscription fees, no hidden costs.

Shein Saver Free Shipping Explained

One of the most common questions is: Does Shein Saver include exclusive discounts or free shipping?

- Yes, sometimes. Depending on your location, cart value, and promotions, Shein Saver can reduce shipping costs significantly or make it free.

- However, you trade faster delivery for cost savings.

This flexibility helps Shein balance logistics while rewarding budget-conscious customers.

Shein Saver vs Shein Points System

Many shoppers confuse Shein Saver with the Shein loyalty program or points system. Here’s the difference:

- Shein Saver → A checkout option for cheaper shipping + occasional perks

- Shein Points System → Rewards earned from reviews, app activities, or purchases, redeemable as discounts

You can actually use both together to maximize savings.

Shein Saver Reviews from Real Customers

Customer feedback shows mixed reviews, often based on delivery expectations:

- Positive: “Saved me money on shipping and got a coupon with my order!”

- Neutral: “It took longer than expected, but I saved a few pounds.”

- Negative: “Not ideal if you need clothes fast for an event.”

Overall, Shein Saver works best for shoppers who value savings over speed.

Common Mistakes to Avoid With Shein Saver

- Expecting fast delivery – it’s intentionally slower

- Confusing it with a paid Shein membership

- Forgetting to stack coupons, points, and Saver benefits

By being mindful, you can get the maximum Shein discount membership advantages.

Expert Insights

To ensure accuracy, here are trusted references about Shein’s shopping features:

- Business Insider – Shein shipping & saver options explained

- The Guardian – Shein’s growth and customer perks

- BBC – Fast fashion logistics and consumer impact

These sources confirm Shein’s Saver option is part of its broader strategy to attract repeat customers while balancing logistics costs.

FAQ’s

What is Shein Saver and how does it work?

It’s a shipping option that reduces costs by consolidating deliveries, sometimes offering free shipping or bonus perks.

Is Shein Saver worth it for frequent shoppers?

Yes. If you buy often, the savings and perks outweigh the slightly slower delivery.

How to join Shein Saver program?

You don’t join—it appears automatically at checkout as a shipping option.

Shein Saver benefits vs regular Shein shopping?

Regular checkout prioritizes speed, while Saver prioritizes cost savings and perks.

Does Shein Saver include exclusive discounts?

Yes, in the form of coupons, Shein points, or reduced shipping fees.

How to cancel Shein Saver membership?

There’s nothing to cancel since it’s not a subscription. Just don’t select the option at checkout.

Conclusion

Understanding what is Shein Saver can help you make better shopping decisions on Shein. If you value savings, free shipping options, and extra perks, this feature is an excellent way to cut costs while still enjoying Shein’s trendy fashion. For deal hunters and frequent shoppers, Shein Saver is a smart choice that turns everyday purchases into long-term savings.

BUSINESS

What’s Included in the Instacart Free Trial Offer?

Grocery shopping can be time-consuming and stressful, especially for busy professionals, parents, or students on tight schedules. That’s where Instacart comes in—bringing fresh groceries straight to your doorstep. But before committing to a subscription, many shoppers ask: Does Instacart offer a free trial? The good news is yes. An Instacart free trial lets you experience the convenience of grocery delivery without upfront costs.

In this guide, we’ll cover how the trial works, who qualifies, what’s included, and whether it’s worth upgrading to Instacart Express or sticking with pay-per-order.

What Is the Instacart Free Trial?

The Instacart free trial allows new customers to try the platform’s membership benefits without paying right away. Depending on promotions, this usually ranges from 14 to 30 days.

During this period, users can:

- Get free delivery on eligible orders over a certain amount

- Access reduced service fees

- Enjoy exclusive Instacart promo for new users

- Try features like same-day delivery free for many local stores

It’s essentially a risk-free way to see if Instacart fits your lifestyle before committing to a full subscription.

Instacart Express Free Trial vs Standard Free Trial

Instacart offers two options:

| Feature | Standard Free Trial | Instacart Express Free Trial |

|---|---|---|

| Free Delivery | Sometimes, depending on promos | Yes, on all eligible orders over $35 |

| Service Fee Reductions | Limited | Included |

| Unlimited Orders | No | Yes |

| Trial Length | 14 days (typical) | 14–30 days |

If you shop weekly or more, the Instacart Express free trial gives better value.

How to Sign Up for an Instacart Free Trial

Getting started is simple:

- Visit the official Instacart website or mobile app.

- Create a new account or log in.

- Look for an Instacart subscription trial banner or email promo.

- Enter your payment details (charges only apply after the trial ends).

- Start ordering and enjoy your grocery delivery free trial.

Pro tip: Set a reminder to cancel if you don’t want to be charged after the Instacart free trial period.

What’s Included in the Instacart Free Trial?

Most Instacart membership offers during free trials include:

- Unlimited deliveries on orders over $35

- Reduced service fees compared to standard users

- Exclusive partner promotions (varies by store)

- Same-day delivery for grocery essentials

For parents or homebound individuals, this means fresh groceries, household supplies, and even pharmacy items delivered without the hassle.

Can You Cancel the Instacart Free Trial Before Being Charged?

Yes. You can cancel anytime before your Instacart free trial period ends, and you won’t be billed. Simply go to your account settings and turn off auto-renewal.

If you decide to continue, your plan automatically switches to a paid Instacart subscription trial upgrade.

Pros and Cons of Instacart Free Trial

Pros:

- Try Instacart for free before paying

- Free delivery on most eligible orders

- Saves time for busy lifestyles

- Discounts and promos for new users

Cons:

- Requires a credit card at signup

- Trial length may vary by region

- Some stores still have item markups

Expert Insights on Grocery Delivery Trials

- Consumer Reports highlights Instacart as one of the most widely available grocery delivery platforms in the U.S., with partnerships across major retailers.

- Forbes Advisor notes that Instacart Express can pay for itself if you place more than one order per week.

- CNET Shopping Guides recommend taking advantage of free trials to compare costs across delivery services before committing.

FAQ’s

How long is the Instacart free trial?

Most trials last 14–30 days, depending on promotions.

Does Instacart offer a free trial for new customers?

Yes, first-time users often qualify for a trial.

How to sign up for an Instacart free trial?

You can register on the Instacart app or website by entering your details and payment method.

What’s included in the Instacart free trial?

Benefits include free delivery (over $35), lower service fees, and exclusive promos.

Can I cancel Instacart free trial before being charged?

Yes, cancel before the end date to avoid fees.

Does Instacart free trial include free delivery?

Yes, but only on qualifying orders (usually $35+).

Instacart free trial vs paid membership benefits—what’s the difference?

The trial gives you the same perks as Instacart Express but only for a limited time.

How to get Instacart free trial without credit card?

Currently, Instacart requires a payment method on file, even for free trials.

Conclusion

The Instacart free trial is a smart way for busy professionals, parents, and students to test the convenience of grocery delivery without upfront costs. Whether you’re looking to save time, avoid crowded stores, or simplify meal planning, this trial helps you decide if a full Instacart Express membership is worth it. Just remember to cancel before the trial ends if you’re not ready to commit.

-

HEALTH5 months ago

HEALTH5 months agoGold Potato Calories: What’s Really on Your Plate?

-

TECH4 months ago

TECH4 months agoSmart Tools for Special Education Success

-

FASHION5 months ago

FASHION5 months agoShine On: Clean Silver Naturally

-

ENTERTAINMENT5 months ago

ENTERTAINMENT5 months agoDancing Drops: A Fountain’s Charm

-

ENTERTAINMENT5 months ago

ENTERTAINMENT5 months agoMatchday Spotlight: Today’s Must-Watch Football Showdowns

-

BUSINESS5 months ago

BUSINESS5 months agoBeyond the Poké Ball: Inside Pokémon Center Japan

-

ENTERTAINMENT5 months ago

ENTERTAINMENT5 months agoPanem Reignited: A New Chapter in the Hunger Games Saga

-

BLOG5 months ago

BLOG5 months agoFlattering Cuts for Diamond-Shaped Faces